Trading cryptocurrency can be exciting, but also risky. One way to make money with less risk is through a trading strategy called arbitrage. Crypto arbitrage involves buying and selling the same cryptocurrency on different exchanges to take advantage of small price differences. The key is to act fast before the prices adjust. While it may sound simple, being a successful crypto arbitrage trader requires honing specific skills.

You need to closely monitor exchange rates, utilize trading tools efficiently, and control your emotions. Most importantly, you must be willing to constantly learn in this rapidly evolving landscape. The crypto arbitrage method can generate nice profits but only if done right.

Alright, let’s jump into the main topic and look at the key skills a crypto arbitrage trader needs to thrive!

Know Crypto Prices

To start, a crypto arbitrage trader needs to intimately understand the minute-to-minute price fluctuations of cryptocurrencies across exchanges. This means keeping a close eye on the prices of bitcoin, ether, and any other coins you want to trade. You’ll need to monitor exchange rates on major platforms like Coinbase, Kraken, and Binance as well as smaller exchanges. Keep an updated spreadsheet or use tracking tools to notice price differences across exchanges. This market awareness is key to spotting and capitalizing on arbitrage opportunities.

See Price Differences

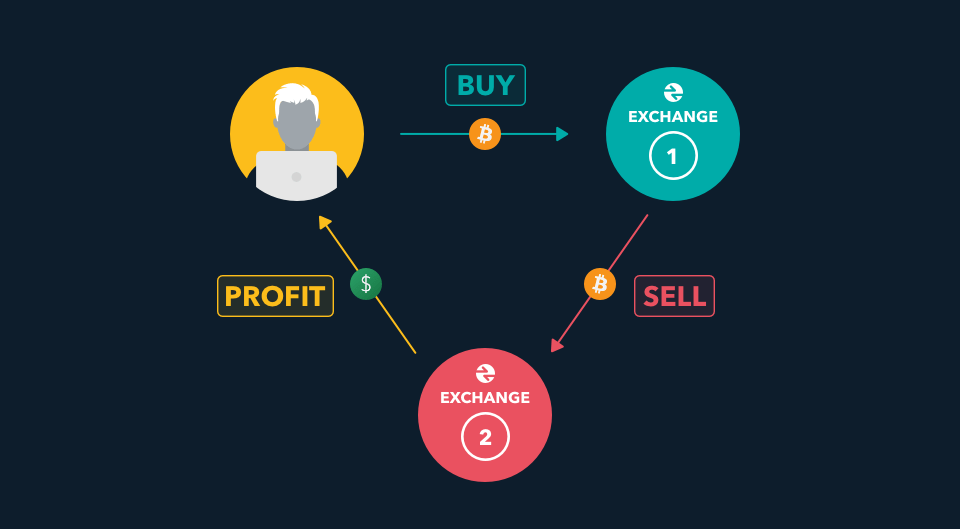

The core of crypto arbitrage is buying a coin on one exchange where the price is lower and then immediately selling it on another exchange where the price is higher. So you need hawk eyes to identify price discrepancies across exchanges, which may only be present for brief moments. For example, bitcoin may be priced at $15,800 on Binance but $15,950 on Coinbase. If you bought 1 BTC on Binance and sold it moments later on Coinbase, you’d pocket $150 in profit. A savvy arbitrage trader is obsessed with monitoring prices and spreadsheets to find these imperfect pricing scenarios.

Act Fast to Buy/Sell

When you discover a temporary price difference between exchanges, you need to execute trades swiftly before the window closes. This means having accounts set up and funded on multiple exchanges with buy and sell limit orders ready. When you spot an ARB opportunity, you must buy on the lower-priced exchange and sell on the higher-priced exchange within minutes, if not seconds. Acting fast is crucial to capturing fleeting mispricing anomalies before the prices align. Slow traders will miss out on chances to profit.

Manage Risks

While crypto arbitrage seems like “free money,” it still carries risks like any trading strategy. You need to manage risks by not overexposing your capital on any single trade. Many arbitrage opportunities will be small, in the 1-3% range, so position sizes should be controlled. Technical snafus on exchanges can also create unexpected risks. System failures may prevent you from completing both sides of the arbitrage, leaving you exposed to market fluctuations. It’s critical to have proper stops in place and diversify across multiple small arb opportunities rather than chase home runs.

Use Trading Tools

To scale arb trading, you need to utilize tools that help identify opportunities faster. Spreadsheet trackers are helpful but limited. More advanced traders build algorithms and bots to monitor real-time pricing across exchanges and place automated trades when arb opportunities arise. Bots act much quicker than manual traders can. Additionally, many arbitragers rely on technical indicators to gain an edge, like moving average crossovers and price divergence indicators. The right tools are a trader’s best friend when competing to capitalize on momentary pricing discrepancies.

Follow Crypto News

It’s also crucial to follow crypto news closely because major announcements can impact prices and create temporary market inefficiencies. For example, if a major exchange announces it will list a new coin, this may cause a brief price surge on that particular exchange as traders rush to buy. This can create an ARB opportunity versus other exchanges in the short term. You need to monitor social media, news sites, exchange announcements, and Reddit forums daily to catch these events as they happen.

Control Emotions

Emotional discipline is key to long-term trading success. Arb trading requires unemotional pattern recognition and execution. If you have FOMO (fear of missing out) you may overtrade and take reckless risks chasing ephemeral profits. If you have fear you may exit too early and leave money on the table. Greed can also cause you to overextend on a position and blow up your account chasing home runs. Developing zen-like calm and sticking to your trading plan is essential. Don’t let emotions cloud your judgment.

Learn Constantly

Finally, any serious arbitrage trader needs to commit to lifelong learning. You can never know it all. The crypto landscape evolves rapidly with new exchanges, coins, regulations, and market dynamics. What worked yesterday may not work today. You need to study arbitrage techniques, analyze your trades, experiment with new strategies, and keep improving. The learning curve is steep, but those willing to climb it can reap the rewards.

Conclusion

crypto arbitrage requires a mix of focus, vigilance, speed, risk management, tools, information, emotional control, and continual education. Master these core trading skills and you can profit consistently without excessive risk through crypto arbitrage. This market-neutral strategy relies on your ability to exploit exchange inefficiencies, not guess future prices correctly. Hone your arbitrage capabilities with patience and discipline.